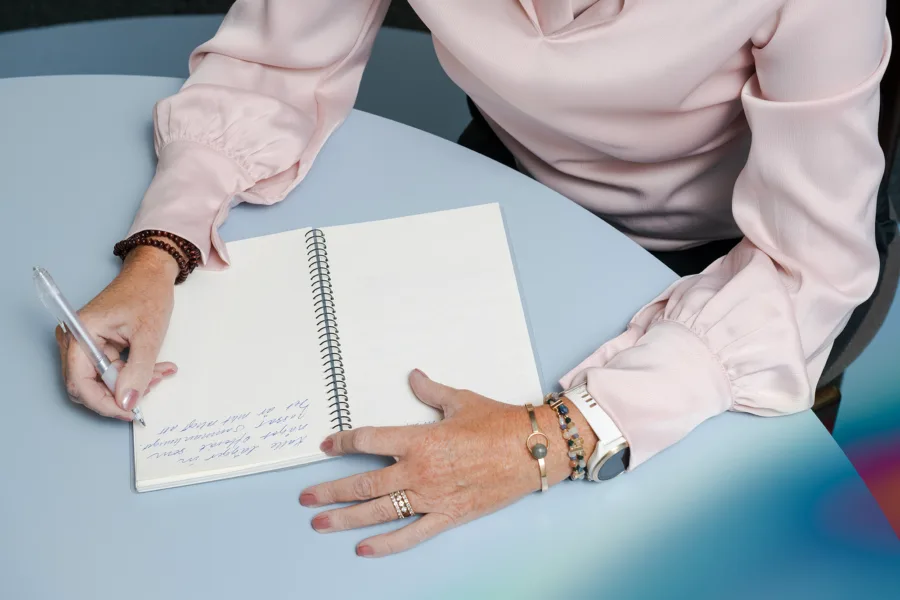

Flagging false positives: How to use data to stop wrongly closing people’s accounts

Trapets CEO Gabriella Bussien advises banks, large and small, on how to reduce the 98% false positive rate and keep customers loyal amid a growing pool of alternative banking options.