Identifying market manipulation: 5 practical examples

Layering, marking the close, and pump and dump schemes, amongst others, are some of the most common forms of market manipulation. In this article, we'll show you 5 common examples of market manipulation and how you can identify them.

Market manipulation can take various forms, such as layering, marking the close, and pump and dump schemes, making it challenging for many institutions to detect and prevent such activities.

In this article, we will explore practical examples of market manipulation to better understand how this crime occurs and its potential impact on the financial industry and investors.

What is market manipulation?

Market manipulation is a criminal act that involves attempting to mislead the market by providing false or misleading signals about financial instruments' supply, demand, or prices. It can also be done indirectly by spreading false or misleading information about a listed company.

5 examples of market manipulation and how to identify them

Before we get into the practical examples, let's explain what each part of the Market and Trade Surveillance solution indicates on the shown graphs:

- The red colour represents the ask side; the blue colour - the bid side. The black colour in between is the spread.

- The white squares and triangles are public trades, and the green squares are the trades we have highlighted, meaning this could be all your trades or for one specific actor.

- The bars below the graph show the volume, while the yellow triangles are the triggered alerts.

1. Advancing the bid

Advancing the bid, or, as our alert trigger is named, repeatedly changing last paid, refers to entering orders to trade, which increase the bid (or decrease the offer) for a financial instrument to increase (or decrease) its price.

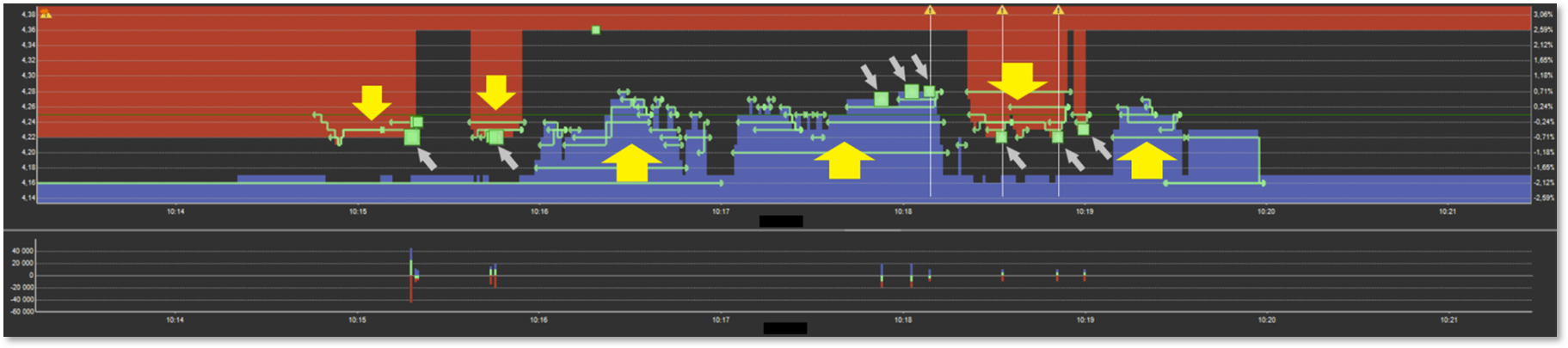

An example of repeatedly changing last paid:

- This actor changes last paid through smaller buy trades, as pointed out by the yellow arrows.

- The trading pattern is systematic, and it's difficult to see a commercial purpose behind these trades other than increasing the price (the commission is, in many cases, a large part of the total turnover for that actor's activity during the day).

- The greater the price movement is for each trade, the more misleading the trades will appear for other participants in the market.

2. Layering

Layering is the practice of submitting multiple or large orders to trade, often away from the current market price, to execute a trade at a more favourable price. After the trade has been executed, the remaining orders not intended to be executed are then removed.

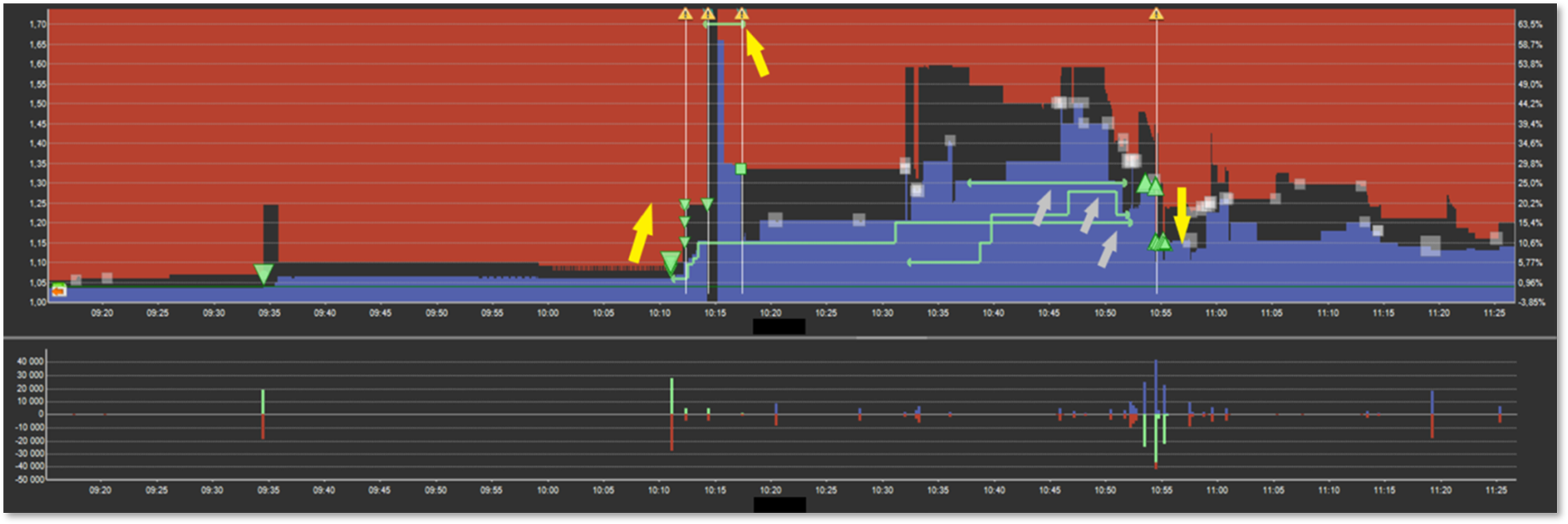

An example of layering:

- The actor places several orders that move the bid or ask side, as shown by the yellow arrows in the example below.

- This tricks counterparties into placing orders at less favourable prices for them. The layering actor then takes advantage of those orders, meaning buying or selling at more favourable prices, as the grey arrows show.

- After these trades, the layering actor cancels the fictitious orders that were placed with no intention of actually being traded on.

- This behaviour is misleading others into acting on orders that show an increase in the bid or ask sides in the order book that are fictitious.

3. Pump and dump

Pump and dump involves taking a long position in a financial instrument, engaging in additional buying activity, and/or spreading false positive information about the instrument to boost its price and attract other buyers. The long position is then sold off when the price is artificially inflated.

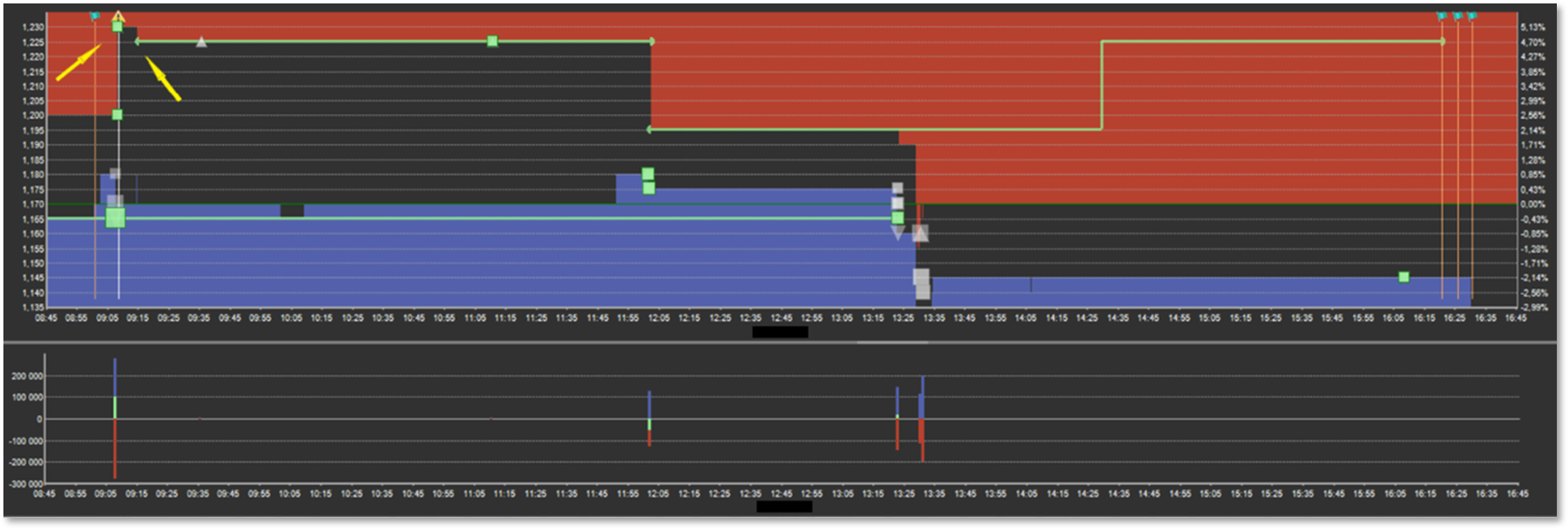

An example of pump and dump:

- The actor buys the stock with aggressive, smaller bid orders that drive the price up. Then, the actor continues to place bid orders, giving misleading signals to the market that there is a growing demand for the stock. As other participants start to trade the stock, the actor cancels the bid orders and begins to sell.

- The actor has started a temporary upward trend through the trading activity and sold the stock at a more favourable price.

4. Misleading signals (Partial execution, intraday or ramping)

Partial execution, intraday or ramping can be summarised as actions that cause false, misleading prices or signals about a financial instrument's supply, demand, or price.

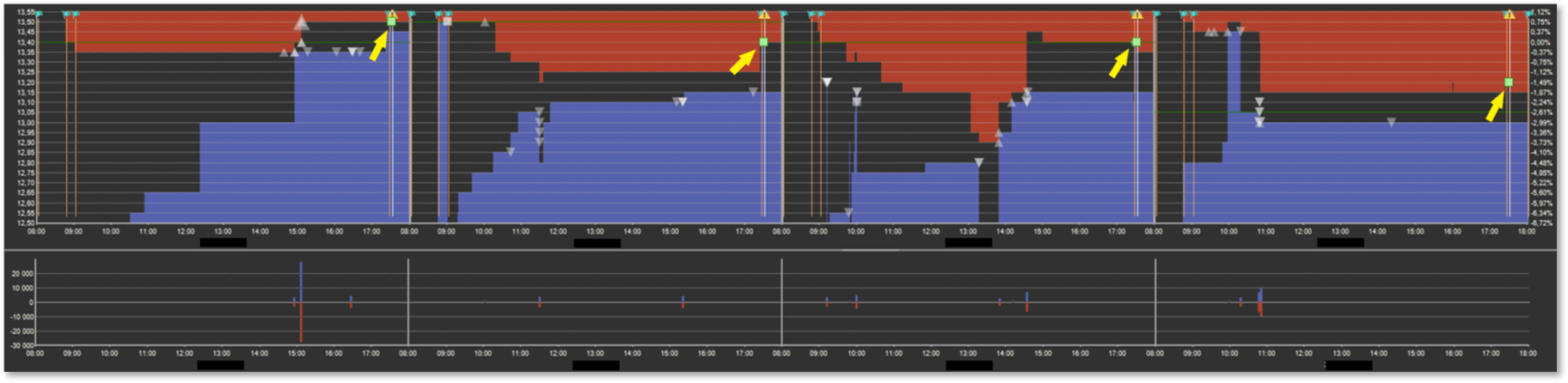

An example of partial execution, intraday or ramping:

- The yellow arrows show that the actor first pushes the stock price up, whereas the last partial trade is smaller and increases the stock price even further. Almost immediately after, the actor places a bigger sell order at a lower limit than the last partial trade.

- It's difficult to see any commercial purpose for these smaller buy trades when the actor has placed a larger sell order at a lower limit than the previous buy trades.

- The purpose of those trades is to mislead other participants in the market to enable the actor to sell at a more favourable price.

5. Marking the close

Marking the close involves buying or selling a financial instrument at a reference time for the trading session (e.g., opening, closing, settlement) to influence the reference price.

An example of marking the close:

- An actor buys shares just before or during the closing to increase the stock price. This is misleading for other participants in the market.

- Actors can influence the NAV for a managed fund in their own favour. This is one of many possible scenarios for when marking the close can be used.

Conclusion

Market manipulation is a serious crime that can significantly impact financial markets and investors. It involves deliberate attempts to mislead the market through false signals or information, and it can be done through direct trading activities or by spreading false or misleading information.

Recognising common indicators of market manipulation and understanding the motives behind such behaviour is crucial for market surveillance and investor protection.

By staying vigilant and informed, market participants can work towards maintaining the integrity and fairness of financial markets.

Don't miss out on industry news

Sign up to our newsletter to receive the latest news within the financial crime industry and to receive invitations to our webinars.