Compliance teams aren’t short on data. The real challenge is making that data useful enough to stop financial crime before it spreads, and clear enough to back every decision you make.

At the first edition of Compliance day by Trapets, we explored both the bigger picture of data and its practical applications, looking at how data influences our decision-making, how to structure it, and ultimately transform it into meaningful, targeted actions.

From understanding why our instincts often fail us when interpreting data, to keeping up with real-time compliance and practical examples of how to structure data and define alert logic, one common message was shared amongst the participants: good compliance depends on clear data, fast response times, and decisions grounded in facts.

Whether you’ve missed the session or want to learn more about the discussions we’ve had during the event, here are three takeaways that every compliance team can apply in their processes.

Compliance needs data fluency, not just human intuition

On stage: Olof Gränström, lecturer, political scientist and expert on data and decision-making

Olof’s session began with a critical reminder: data volumes are growing, and technological innovation is moving faster than ever, which means that intuition can no longer be your sole guide in making decisions.

Without a fact-based understanding of the world, even experienced analysts fall into cognitive traps, seeing patterns that aren’t there or missing the ones that matter.

What this means for financial crime prevention teams:

- Start questioning default beliefs and build processes that rely on current data, especially when assessing customer risk, market behaviour, or geopolitical exposure.

- Rely on your systems and data, not just your instincts. Prioritise analytical tools that can detect patterns and use them to support, rather than replace, human oversight.

Compliance will shift towards real-time

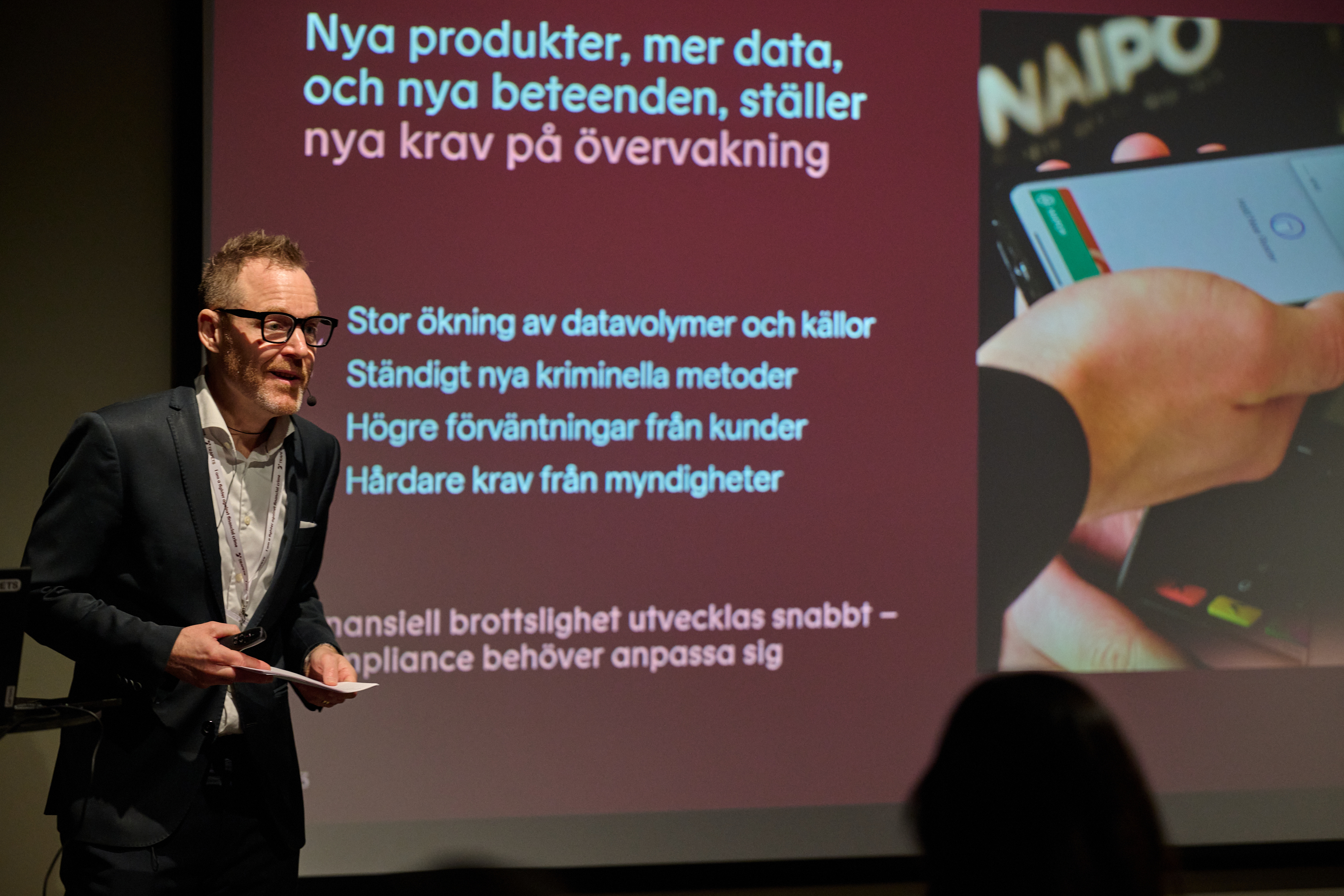

On stage: Niklas Rosvall, Chief Product Officer at Trapets

Niklas made it clear that real-time compliance is increasingly becoming the norm for compliance teams.

Financial crime develops fast, new regulatory frameworks put more pressure on teams, and customers ask for more seamless experiences. All these factors lead to a shift from delayed, batch surveillance to immediate action.

From AMLR (Anti-Money Laundering Regulation to MiCA (Markets in Crypto Assets Regulation), compliance teams are expected to screen, verify, and act in real-time.

The time between detection and intervention can no longer be measured in hours or days. It can become a matter of minutes.

Fraud, money laundering, and market abuse all exploit timing. If a suspicious transaction clears before it’s flagged, or if a market order goes through before it's stopped, the damage is done.

Niklas highlighted some examples where the solution is already within reach: pausing transactions, freezing accounts, and stopping high-risk trades in real time.

What this means for financial crime prevention teams:

- Compliance must be set up to act fast. That requires effective workflows across departments, ownership of data, and systems that support immediate decision-making.

- Real-time compliance is about shifting from observation to prevention, and meeting risk head-on, at the moment it occurs.

Clean data is the foundation of compliance

On stage: Sophie Bahgat, Head of Group Financial Crime Prevention, DNB Carnegie

Compliance starts with data: a simple, but powerful reminder for everyone who attended the event. If your systems are built on outdated, inconsistent, or undefined data, it doesn’t matter how advanced your tools are; the output will fail to meet expectations.

Sophie demonstrated that data hygiene isn’t a backend task to be handled once a year. It’s the operational backbone of everything else your financial crime prevention team does.

Old transaction types, legacy product codes, and poorly defined customer categories introduce risk and reduce the value of automation.

Many organisations rely on overly broad customer categories that do little to support risk-based decision-making.

Building smart, behaviour-based customer segments improves everything from alert accuracy to the effectiveness of your enhanced due diligence.

What this means for financial crime prevention teams:

- Start with the basics: clean your data fields, remove what’s no longer used, and define your categories clearly. Every alert, every risk model, every investigation starts with input. If that input is wrong, the rest will follow. Make sure that your data segmentation accurately reflects the risks identified in the annual AML/CTF risk assessment, which should serve as the blueprint for your entire operation.

- Use the data already in your systems to create relevant customer segments. Look at parameters such as age, geographic risk, transaction habits, source of funds, and risk indicators to ensure that you can set up risk-based processes for transaction monitoring, KYC and customer risk classification.

- Align your alert logic with customer segments and behavioural patterns. Let your KYC data feed your monitoring systems to create models that are docked into each other, because that's the intent of the AML regulators' thought behind the rules we follow.

- Let smart dashboards and BI (business intelligence) visualisation tools be your new virtual team member in your financial crime prevention teams. Visualising risks and operational effectiveness will help you realise and understand your financial crime risks on another level.

Final thoughts

The future of compliance doesn’t start with AI agents or ground-breaking systems. Instead, it must evolve into a connected, insight-driven function, deeply integrated with the business, powered by real-time systems, and grounded in clean, structured data.

Want to know what else is coming up at Trapets? Check out our upcoming events and webinars.